The OTC Markets Group is the owner and operator of the most substantial U.S. inter-dealer electronic quotation and trading system for over-the-counter (OTC) securities. It provides marketplaces for trading 10,000 OTC securities, making it the third-largest U.S. equity trading forum.

The OTC Markets Group breaks their financial markets down into three tiers, distinguishing companies based on the quality and quantity of the companies’ disclosure and financial information. this division provides different levels of transparency and risk for investors.

OTC Markets Tier Structure

OTCQX: is the top tier of the three marketplaces for the OTC. Stocks that trade on this exchange must meet very strict qualification criteria compared to the other levels. This market includes a large number of blue chips stocks from Europe, Canada, Brazil, and Russia. These large foreign stocks are frequently global household names. Penny stocks, shell companies, and companies in bankruptcy cannot qualify for a listing on the OTCQX.

OTCQB: also known as “The Venture Market,” this is the middle tier of the 3 marketplaces of the OTC. This exchange consists of early-stage and developing U.S. and international companies that are not yet able to qualify for the OTCQX. The company must be current in their reporting, undergo annual verification and certification, meet a $0.01 bid test, and may not be in bankruptcy to meet eligibility standards. Companies listed here report to a U.S. regulator such as the SEC or Federal Deposit Insurance Corporation. The OTCQB replaced the Financial Industry Regulatory Authority (FINRA)-operated OTC Bulletin Board (OTCBB) as the main market for trading OTC securities that report to a U.S. regulator. As it has no minimum financial standards, the OTCQB includes shell companies, penny stocks, and small foreign issuers.

OTC Pink: Also known as “Pink Sheets” is the lowest tier exchange that the OTC Markets Group offers. This marketplace offers to trade a wide range of equities through any broker and includes companies in bankruptcy, financial destress, default, or even non-existent companies whatsoever (shell companies). OTC Pink has no disclosure requirements, so the categorization of these companies is based solely on info provided by them.

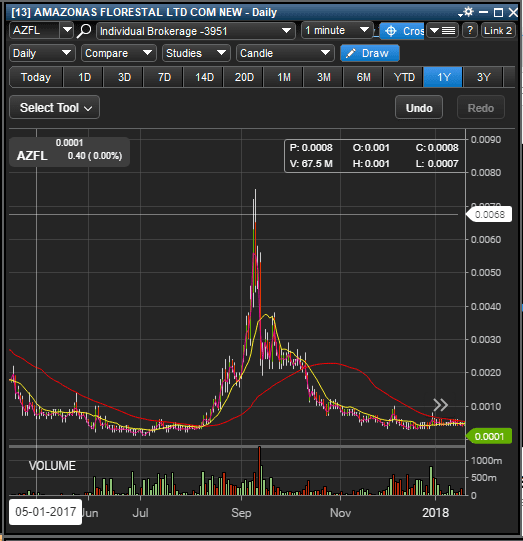

OTC stocks can be very lucrative if traded properly, based on the fact that they are so low priced. It is a lot easier for these types of stocks to spike significant percentages (50%, 100%, 500%) since they are a low lower priced and a lot less liquid. However, they can drop just as fast:

Here is $AZFL, an OTC Pink company that ran from around .0006 to just about .0077 in less than 2 months, leading to gains of over 1000%. When it lost momentum though, it dropped like a rock and presented no real exit opportunities for people who chased. Now it is sitting at .0001, meaning anyone who held the bag through this play has lost all of their money.

When trading OTC stocks, its very important to understand that they trade vastly different than NASDAQ listed or AMEX listed stocks, due to the fact that they do no have electronic automated market makers to facilitate transactions. OTC stocks are generally a lot less liquid, meaning that it can be very hard to exit your position without subjecting yourself to a lot of slippage.

99% of these companies will eventually fail, so never get ‘married to the news’ or hold on to a loss hoping for a bounce!