Building a watch list of tickers that fall within your trading strategy is an essential part of profitable trading. There are roughly over 15,000 stocks that trade on the US markets alone; far too many for you to be able to filter through each and every one. Attempting to do this would leave absolutely zero time for actual trading!

Thankfully the modern trader is spoiled with an abundance of stock scanners and screeners they can use which will help filter out the noise and find strong stocks.

Your daily watch list ideally starts out rather large in premarket, and then throughout the trading day it should evolve and wind down to only 2 or 3 stocks to focus on.

Step 1: Know Your Strategy

The first step in your watch list generation is to really understand what type of stocks you are looking for. Now, there really is no right or wrong answer for this; It really boils down to what strategy you trade. If you trade multiple strategies, its generally best to have separate scanners for each. This will keep things neat and simple to follow.

Do you primarily trade big chip stocks? Then your scanner settings would likely only include stocks over $10 per share. Only small caps? Then your scanner settings should ignore all stocks over $10 per share. You can scan for hundreds of parameters like Float, Dollar volume, Percent Change to identify exactly what you are looking for.

Think about your strategy and what common parameters any stock would need to fit in order to fall within it. For example, let’s say that your strategy is to dip buy stocks that are extremely sold off. You have a particular interest in low float stocks breaking new 52 week lows, so you can use that to your advantage:

- Strategy: Dip Buy All Time Lows with Volume

- Trigger: Breaking 52 week lows

- Float: Less than 25 million shares

- Volume: Greater than 100,000

A scanner that had these parameters would immediately filter out thousands of stocks that do not fit your criteria.

This immediately prevents you from overtrading or trading stocks that are out of your criteria, which will immediately increase your profitability. It will also transform your process into a more process-orientated one, one which you can build a daily routine around.

Step 2: Using Scanners To Develop The Watch List

It’s important to note that not ALL stocks on your scanners will become trade setups.. they are just stocks with potential trades. It’s very important to further verify that the stock can become a

The scanner that I use daily is Scanz, read more about it here

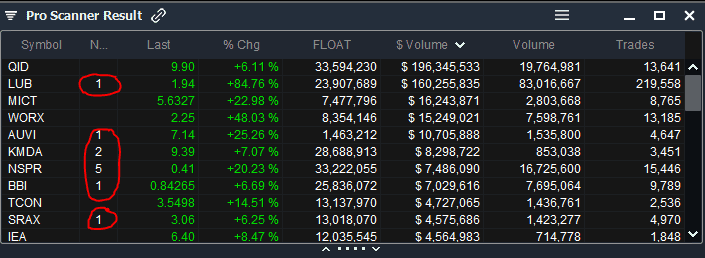

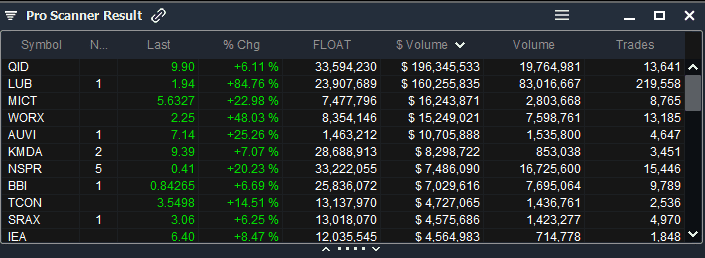

Here is a breakdown of one of the main scanners that I use within Scanz:

- Price : Between $0.10 and $10.00

- Percent Change: +5%

- Day’s Trades: 250

- Float: < 35 million shares

This will essentially find any Small Cap Stock that is green on the day with some sort of catalyst. The percent change ensures its green on the day, and having more than 250 trades hints that it is somewhat liquid. Obviously, most of the stocks I trade have thousands of trades, but I don’t want to cast my net too small early in the day.

If you don’t have Scanz or can’t afford it in your current trading budget, that’s totally fine. Most brokers nowadays like ThinkOrSwim and WeBull have built-in scanners that work pretty well. You can also find a free scanner on Finviz, although that one is very lacking in its features.

Depending on your strategy, you’ll want to either scan for stocks after market close, or before market open. I Start my morning at about 4:00am (7:00am EST) and have my scanners run continuously throughout the day.

This allows me to see stocks as they cross my scanner parameters, allowing me sufficient time to run the stock through the TradeBuddy Trading Checklist and plan a trade before it’s too late.

Having real-time scanners can give you a massive edge, whereas a scanner like Finviz only updates every time you refresh the page.

Step 3: Creating Your Watch List

This is where you decide whether or not any particular stock that shows up on your scanner is actually worthy of your attention.

Remember, a stock simply showing up on your scanner does NOT mean its time to buy. I purposefully cast my scanners ‘net’ very wide so that I can see a broad range of stocks; I understand that a ton of them simply wont be worthwhile. It only takes a few seconds for me to view the daily chart and the catalyst and come up with a decision to trade or not.

For my strategy, I simply look at each stock that has a news catalyst. In the above picture example, the stocks that I would look at first are LUB, AUVI, KMDA, NSPR, BBI, and SRAX.

The numbers next to the symbol represent amount of news releases today

By clicking on the # of news releases I can quickly view the news causing the stock to run. Then, if I am a fan of the news I will pull up the ticker and look at the Daily time frame. I then determine whether or not it fits my ‘A+ Setup’ and go from there. You can learn more about this strategy by signing up for the free trading workshop

From here, you would have ideally created a Trading Plan. This means you identified levels where you want to enter the stock, levels that you want to lock in profits, and the level that you will stop out for a loss at.

Having the trading plan ready BEFORE you take the trade is an absolutely integral part of trading.

Once you’ve analyzed each chart with news, you can decide whether or not you want to look at other stocks, depending on if you have enough plays for the day. This is where trader intuition and experience can really save you time; You’ll start to naturally figure out what stocks will not be in play based on their share structure, volume, and catalyst.

Step 4: Maintaining your Watch List

Once you reach this part in your daily routine, it should be very clear which stocks are in play based on your trading strategy. Now, your job is to simply have all of these stocks on your watch list, as long as their potential remains true.

Has a stock completed its move? Did it fail to do what you expected? It is your job to maintain the watch list appropriately. A watch list is only as good as the trader that maintains it!

At the end of the day, review your watch list again. If there are any stocks that are lasting on your watch list, you can choose to either move them to your long-term watchlist or have them ready on the following day’s watch.

Always make sure that your watch list is never too cluttered, and always take time to review the stocks on your list in order to ensure that they deserve your attention

Final Thoughts

Having a watch list is very important for any trader, day trader and swing traders alike. Using modern scanning tools allows you to focus on the stocks that truly matter.

With every trading process, its important that you follow a consistent routine to eliminate any possibility of variables ruining your edge. My watch list development follows a strict morning routine that I repeat day after day, and I recommend that you do something similar.

Be sure that you know what your trading strategy is and what you are looking for; from there its simply a matter of learning how to use the scanners to find what you need.

Need help finding your strategy, or simply want to copy our watch lists? Join TradeBuddy today via our 14 Day Trial