Webull Review 2020

In this review we will cover the pros and cons of the Webull Broker.

We will look into its tools and features for day trading as well.

As a bonus, we will compare this broker to others such as Robinhood.

Lets jump right in.

Zero Commissions Saves You Money

As stated above, Webull offers commission-free trading to over 5,500 U.S Stocks and ETFs with zero charges to open or manage an account. At this time, Webull does not offer Options Trading, however is working on getting it implemented and should be a feature that will be available sometime in early 2020. There are zero fees to access real-time U.S market data, however you have to pay a subscription-based fee in order to access Level 2 data. International markets also require a subscription-based fee that can be chosen through the app.

Charts and Technical Analysis To Place Better Trades

The real-time and very user-friendly charts can be infinitely customizable depending on your trading style.

Options range from candlestick, bar and line charts.

Time frames can be set to:

- 1-minute

- 5-minute

- 60-minute

You can even going up to daily, weekly, and monthly time charts.

Data goes back over a five year period and there is a very neat feature where you can replay the price action from any time during the past 30 days,

In addition, you can replay historical price action.

This can be done for any trading within the past 30 days.

This is great to study how a specific stock traded in real-time.

In addition, many indicators are offered by Webull.

For example:

- Moving averages

- VWAP

- Bollinger bands

- MACD

- RSI

- and so much more.

You’ll also get charting tools to draw right on the chart.

Tools & Analytics to find better stocks

If you are a value investor or a swing trader who focuses on the fundamentals of a company, Webull is your dream come true.

Some powerful analytical tools include:

- Live News streams

- Press release and filings

- Historical EPS and revenue data

- Insider holding statistics

- Analyst recommendations

The graphs and charts provided with the fundamentals make the data easy to digest and allow you to quickly make your decision on whether or not the stock is a strong buy.

You are able to dive deep into the companies profile and operations, catalysts, and overall performance to gauge exactly what is causing the stocks price to fluctuate. As a bonus, you are able to save specific articles for future reference and even comment on certain stocks.

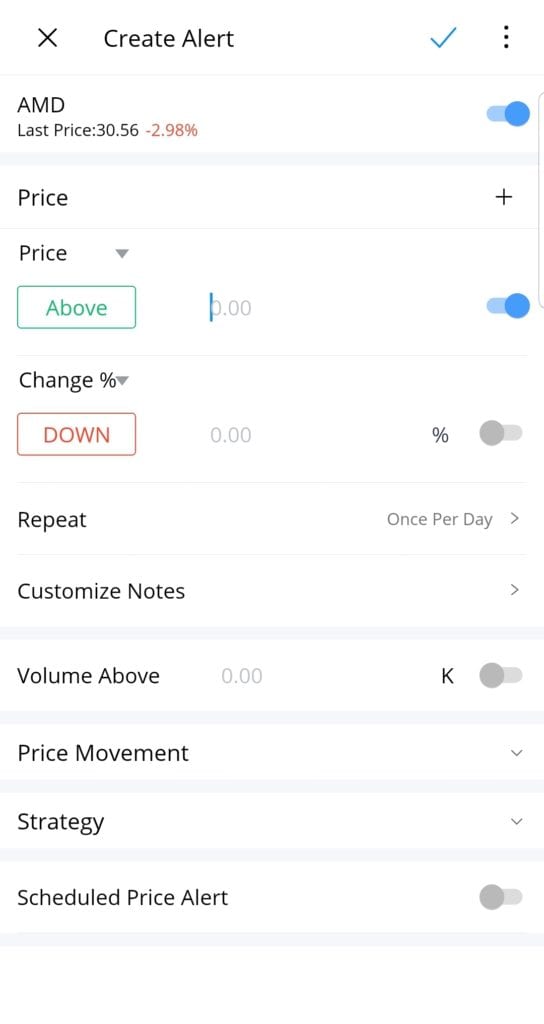

Watch List and Price Alerts allow you to never miss a trade

You are able to put together multiple watch lists in order to effectively track any sector or specific strategy that you wish. This is unlike other brokerages that only allow one basic watch list.

Additionally, Webull has what are called ‘Smart Alerts’ that will notify you via push notification, SMS, or e-mail when one of your alerts have been triggered. These alerts will notify you when a stock has passed a certain price level or indicator that you set.

Paper Trading that helps you practice

One HUGE advantage that Webull has over the other free-commission brokers is the ability to paper trade right on their platform. It simply doesn’t make sense to jump in with real capital right away if you have zero clue what to do and if your strategy is consistently profitable.

Just like a doctor first practices on simulations and models of the human body, a trader should always first practice in a simulated setting so they do not risk real cash. While their paper trading is slightly lacking in some features, it is still a huge plus that they include paper trading in the platform. I am sure that they will implement limit orders as time goes on, so this won’t be an issue for too long.

Get a Free Stock worth up to $1,000 When You Open a Webull Account

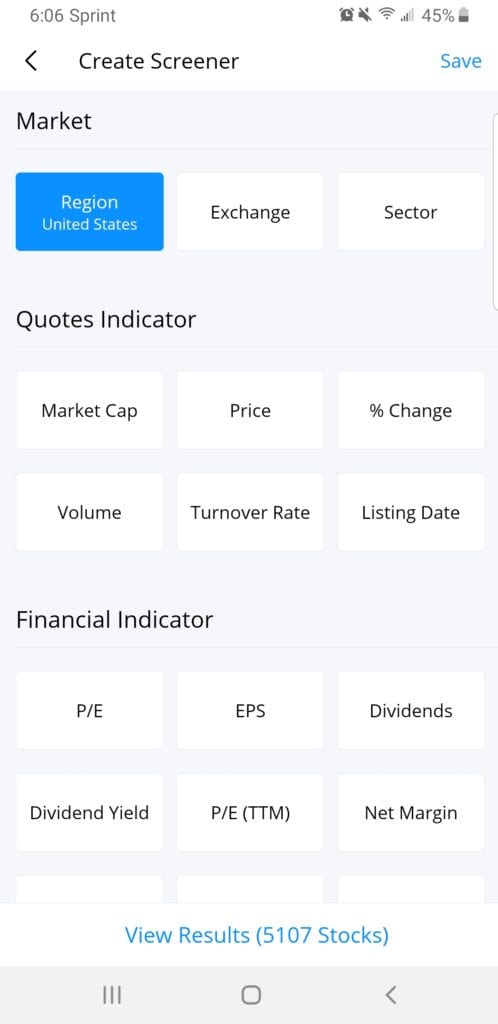

Custom Stock Scanners

This is one tool that vastly sets Webull apart from other free-commission brokers like Robinhood. Within Webull, you are able to scan for stocks based on a specific criteria that you set. You are able to filter based on financials like P/E, EPS, Dividend Yield, ROA and others. You can also filter by technical indicators like MACD Golden Cross, RSI24 Oversold, MA 5 Cross Over 10, as well as basic quote scans like market cap, price, % change, and volume. This allows you to quickly and effectively identify stocks that fit your exact strategy and saves you a ton of time.

Webull Margin Accounts, Leverage, and Short Selling

Webull allows short-selling through their margin accounts and also offers up to 4x intra-day margin and 2x overnight margin.

Net account balances must remain above $2,000 in order to avoid a margin call. If your balance drops below $2,00 while in a short position, the broker will automatically send a market BUY order and liquidate your position. Be sure to have a padding of account balance if you want to short so you don’t get accidently liquidated!

Webull’s Customer Service smashes the competition

For being a free commission broker, the amount of customer service options that Webull offers is pretty amazing. They have support agents available via live chat, phone, and email. The wait time is very minimal nd the agents are knowledgeable enough to handle any question that you throw at them. This is very important during trading hours in case you are having an issue with your orders and are ‘stuck’ in a trade!

You never want to have slow service when money is on the line, and I applaud Webull for keeping up good customer support standards.

Is Webull Better Than Robinhood?

With Robinhood being the most popular free-commission broker that is currently available, its not surprise that it is the #1 broker that Webull is compared to. Yes, they do both offer free commissions, but the similarities basically end there. The amount of functionality packed into the Webull app, as well as having a fully functional desktop app, sets it far ahead of Robinhood in my opinion. Their customer support is much quicker and you can simply do more with the Webull app, while still benefitting from free commissions.

Having more tools at your disposal is a big bonus.

For example, Webull has these features that Robinhood doesn’t.

- Better charts

- Custom scanners

- Custom Trade alerts

- In-depth market research

Webull also allows free options trading. This means there is ZERO reason to choose Robinhood over Webull.

Final Thoughts on Webull

Pros:

- Zero Commissions For Trading

- Free Paper Trading

- Desktop & Mobile App

- Fast Customer Service

- Very Customizable

Cons:

- Level 2 Costs an Additional Fee

- Desktop App is lacking in customizability

- Paper trading has limited features

Overall, Webull is a very powerful broker to use if you are a new trader looking to jump into trading.

You will maximize your profits with zero commissions.

Active day traders will save a lot of money by switching to Webull.

I would definitely recommend Webull as the #1 broker to use if you’re looking to jump into trading!

Sign Up For Webull Today and Get a FREE STOCK worth up to $1,000

Which feature are you going to take advantage of the most when you sign up for Webull? Will it be the paper trading, their custom scanners, or their powerful charting software? let me know in the comments below!

March 21, 2020

Hope you all gained value from this review!

What features you do like the most about Webull?

Let me know!