Every Trader is looking for their A+ setup – the one that’ll increase their odds and make it possible to win most of their trades. The reality is, there’s no perfect setup. Sometimes things simply go wrong and there’s nothing you can do about that.

But in an imperfect world, there are plenty of good trading setups and strategies that any trader can benefit from using.

Breakout Trading happens to be one of them. The cool part? There’s more than one way to play a breakout and different types of breakouts present different opportunities. If you want to learn my breakout trading strategies, get my Top 10 Trading Setups PDF. It’s the best cheat sheet you can get and its completely free.

What Is Breakout Trading?

Let’s first get to the basics and define Breakouts first. A Breakout is a price movement through a level of historical resistance. Don’t know what resistance is? Get into TradeBuddy University today with a 14-day free trial.

In the chart above, you can see that Natural Shrimp Inc (OTC:SHMP) broke through resistance levels that developed as the stock’s price dropped over the course of several months.

Notice the volume candles at the bottom of the chart when the breakout happened; Volume and volatility will always occur at or near breakout levels.

Now, the obvious way to play this strategy is to buy (go long) on the breakout and then sell and take profits as the stock squeezes higher.

Benefits of Trading Breakouts

Like every single pattern that myself and my students use, there’s a statistical edge within our favor. It’s the probabilities of success stretched out over hundreds of trades that we care about; not individual wins or losses

Risk Management For Breakout Trading

As with every strategy that I teach, breakout trading should be clearly planned out. You should have an extremely clear understanding of exactly where you are going to enter the trade, where you will be taking profits if you are right, and where you will be cutting your loss (QUICKLY) if you are wrong.

Every day-trading strategy that I use includes risk management. It’s simply built into the strategy.

Risk management is an extremely important concept; it’s one of the 3 “Pillars of Trading” and you should spend a significant time learning the best risk management strategies and understanding it to its fullest.

Risk management can help you control losses and optimize your profit taking. The most important thing with risk management is a risk:reward ratio, which provides a way for you to determine if a potential trade is worth it or not.

My Favorite Breakout Trading Patterns

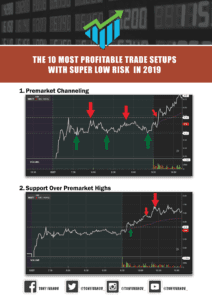

I detail my favorite Breakout Trading Patterns in this free PDF so I highly recommend that you get it! It only takes a few seconds to obtain and it will REALLY change the way you look at trading if you haven’t been exposed to topics like these before. Here’s a sneak peek of what you’ll get:

Master your Craft with TradeBuddy University

As you can see, you need to study up! Join TradeBuddy University today via a 14-day free trial if you’re serious about trading. You get access to my video lessons, live webinars, one of the best trading chat rooms around, 24/7 communication with our top mentors, breakdowns of my trades and in-depth analysis of the biggest runners in today’s market.

It’s an amazing program that can help you on your path to becoming a self-sufficient trader.

Conclusion

Breakout Trading is one of the most consistent ways that traders grow their small accounts. However, it is not a fool-proof system. You must make sure that you are trading the right types of breakouts and always follow a plan when doing so.

Are you a trader? What’s your experience with trading breakouts? Comment below and tell other traders about your best breakout trade and give tips on how to be successful doing so!

New to trading? Comment below saying “I will learn to trade breakouts!”

February 12, 2019

I will learn to trade breakouts!

Thanks again for the tips – I’ll be joining the trade buddy university soon.